World War 3 on the way? (Pt.3)

Capital markets, as predicted, have responded to the ongoing Russian invasion of Ukrainian soil. How does this affect UK stocks in particular?

Before you read this article, please read ‘World War 3 on the way? (Pt.2)’

World War 3 on the way? (Pt.2)

Recapping from what we learnt in Pt.2, we learnt that we can use stock indexes as a measure of a stock market’s performance. Now we are going to use the FTSE 100 index in relation to the UK stock market.

When did Russia actually invade Ukraine? Historically, Russia actually invaded Ukraine back in 2014 when they took the area of Crimea. This invasion went below a lot of people’s noses possibly due to the fact that it was not widely reported about in comparison to the current invasion. The full-scale invasion of Ukraine that has been on the spotlight occurred on Thursday the 24th of February 2022. Let’s look at how the FTSE 100 performed. The day before, 23 February, the FTSE 100 stood at 7498.20 points. On the day of the invasion, the index stood at 7207.00 points. This means that the FTSE 100 closed 3.9% lower than the day before. As of writing this article, the FTSE 100 is now stood at 7190.72 points, showing a 4.1% decrease. These percentages are quite low but they will have hurt the investments of investors who have investments in passive mutual funds or ETFs that track the FTSE 100 index.

For illustration purposes, assume an investor had invested £1,000 into BlackRock’s iShares Core FTSE 100 ETF on the 23rd of February. That same £1,000 invested will be worth £961 the following day. That’s a nominal value loss of £39 in just one day. If the investor put £100,000 instead, his/her investment will be now worth £96,100, resembling a loss of £3,900. Now you can see how an investor who was probably based in the UK could have been affected by the invasion occurring in Eastern Europe. You can lose money from the actions of others. This is why investment decisions should not be just made impromptu without significant research. Additionally, as we have seen, the FTSE 100 continues to fall from the time Russia invaded Ukraine. Being updated on current national and international affairs is paramount when it comes to being an investor and the timing of investments are key to determining whether you make a profit or a loss. But not everyone was hit by the invasion! The company I about to look into actually benefits from wars.

Ever heard of BAE Systems? BAE is a FTSE 100 company — headquartered in the county I live in, Hampshire, that provides defence, aerospace, and security solutions worldwide. It is the largest defence-contractor in the world and the seventh largest in the world based on 2021 revenue. The following screenshots show some of BAE’s customers.

As you can see above, BAE’s customers are majority government’s defence departments especially those from Australia, Canada, Finland, Germany, Saudi Arabia, Spain, Sweden, Turkey, Qatar, the USA, and the UK. Majority of these countries are NATO members and they have all increased their defence budgets due to the invasion. This means that these countries are demanding more of BAE’s services, leading to increased revenue and profits for BAE. Let’s look at how BAE’s stock has performed over the past two weeks.

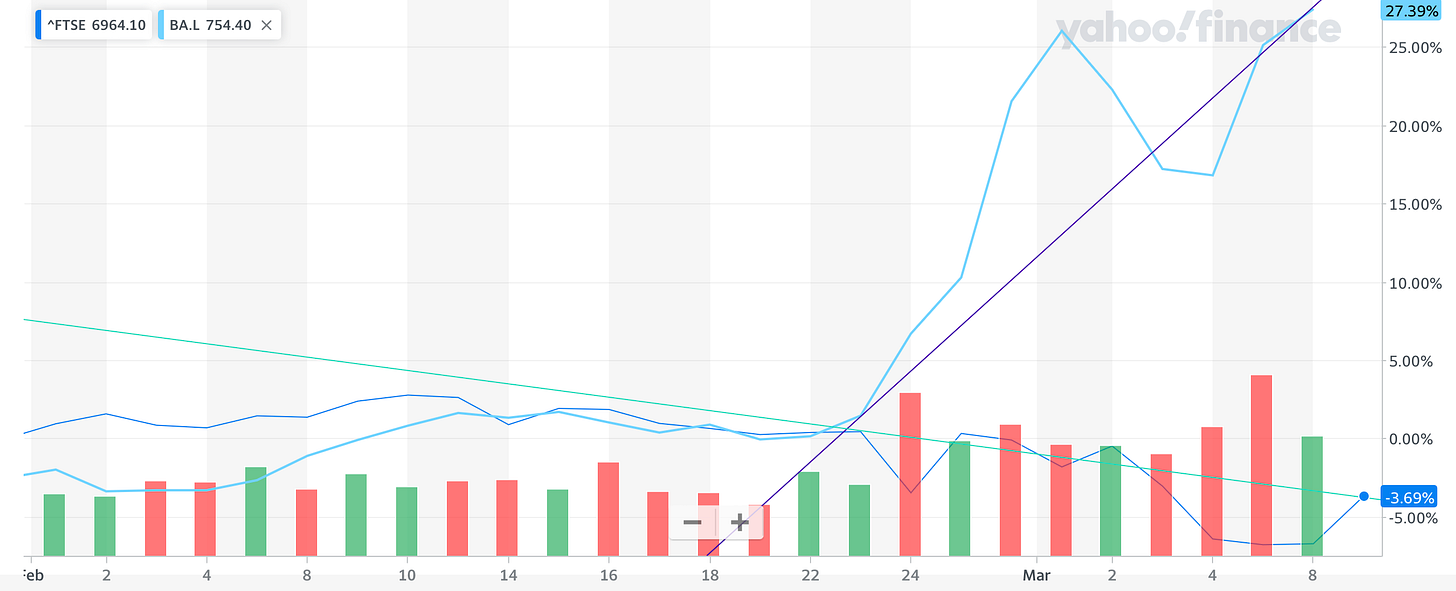

The light blue line represents BAE whilst the dark blue line represents the FTSE 100 index. This graph shows a negative correlation relationship between BAE and the FTSE 100.

BAE’s stock actually increased from 600.80p (£60.08) on 23 Feb to 631.80p (£63.18) on 24 Feb, the day Russia invaded Ukraine. A 5.2% increase in the share price. As of today, BAE closed at 722.60p (£72.26), a whooping 20.3% increase. This means that if you bought BAE shares on the 23rd of Feb worth £1,000, you would have £1,203 today. If you invested £100,000, you would have £120,300. With the invasion still ongoing, BAE shareholders will be eating for real! As the FTSE 100 has been plummeting, BAE’s stock has sky-rocketed!

This is the conclusive post of the ‘World War 3 on the way?’ series. I hoped you gained knowledge about the domino effect — how oil prices affect the global economy, what stock indexes are and their uses, and how not everyone is a loser when the stock market ‘crashes’. The most important thing is that if you want to be a successful investor, you need to know the current affairs to ensure you make the right investment decision at the right time. The Russian invasion may have affected the majority of UK stocks due to increased oil prices and fear amongst investors about the possibility of a World War 3, however, as we have seen, a company like BAE Systems has profited from the possibility of a World War 3. Similarly, during peak COVID times, pharmaceutical and biotech companies like AstraZeneca, GSK and Pfizer benefited from the pandemic. When there is a loser, there is always a winner!

Kind regards,

Nqobani Ndebele

Disclaimer: I am not qualified to give financial and/or investment advice. These are my personal opinions and remember every time you invest, your capital is at risk.