EUR(€) is now weaker than the USD($).

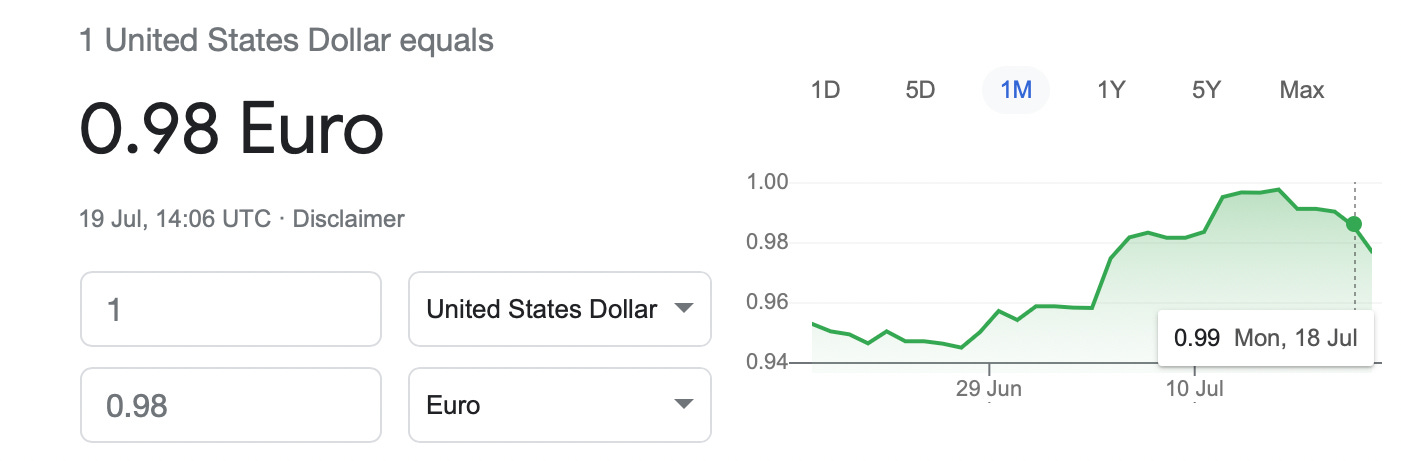

As of writing this article, the USD is stronger than the EUR with $1 worth €0.98. How did it get to this point?

Currencies fluctuate a lot. Growing up as a Zimbabwean, knowing about the current economic situation become a norm. I lived through an era where you will barely find anything in supermarkets. I remember when my mother would fly over to South Africa and come back with large quantities of bread during 2008, which has to be the year of Zimbabwe’s worst economic crisis. I would head over to my primary school’s tuckshop with billions of Zimbabwe Dollars just to buy some sweets or chips.

Economists and students are familiar with Zimbabwe due to the hyperinflation that occurred in 2008 where it peaked, according to Forbes, at 89.7 sextillion (10^27) percent.1 Even before I left Zimbabwe for university, I would occasionally visit various black-market dealers that could assist me in converting my USDs into bond notes/RTGS, the legally accepted currency stated by the Zimbabwean government, and find the dealer that would give me the best deal. The Zimbabwean experience has always got me interested in currency exchange rates and I would now like to look into the depreciation of the EUR.

Recently, headline news broke out that the EUR was at parity with the USD and currently $1 is now worth only €0.98.

Source: Google Finance

The question is how did the USD become stronger than the EUR. Through my research, I would like to explain the logic behind the cause of the currency depreciation and was it due to the EUR becoming weaker or the USD becoming stronger.

The last time that the EUR was at parity with the USD was in 2002, and this was during the early stages of the Euros existence. During the 2008 financial crisis, the EUR was 1.6 times of the US dollar. One of the most logical indicators to the EUR being worth less than the USD is due to the Russian invasion of Ukraine. Looking from an economic point of view, the Ukraine invasion poses a great threat to EU countries due to the supply of oil from Russia.

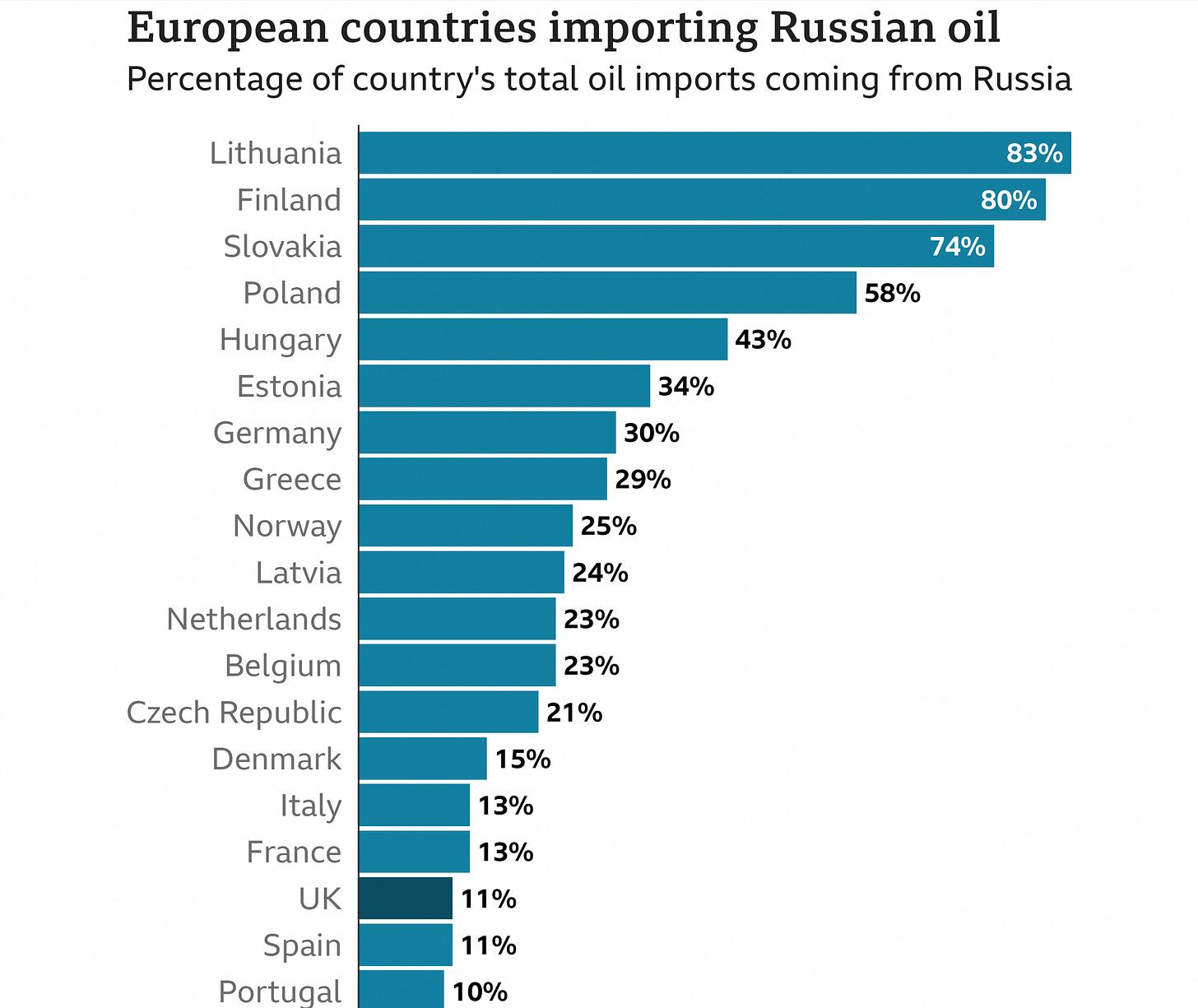

Source: BBC News2

As we can see above, majority of the EU countries are highly dependent on Russian oil. With most Russian companies under sanctions, the supply of Russian oil has been halted. This will prove to be costly to the EU countries because energy bills are likely to rise, thus increasing the cost of living of EU citizens. Another reason for the depreciation in the EUR currency is due to the response of the European Central Bank (ECB) concerning the interest rates as opposed to the Federal Reserve, US’s central bank. As stated by Libby Cherry from Bloomberg;3

At the same time, the US Federal Reserve is raising interest rates much faster than the 19-nation euro area. That makes yields on US Treasury bonds higher than those on Europe’s debt, driving investors to the dollar and away from the euro. What’s more, the greenback benefits from its status as a haven, meaning that as the war drags on and the fallout gets worse, the euro keeps sliding.

Conclusively, I find it interesting to see the EUR actually being weaker than the USD as I have historically known the EUR to be stronger than the USD. Do I think the EUR will once again become stronger than the USD? Yes I do. The main factor for the depreciation is the Russian invasion, which is not a controlling factor of ECB. Once the war ends, I can predict a spike in EUR’s value. Additionally, economics is also dependent on the psychology of human beings. If the people trust the ECB, the Euro is likely to increase. One of the main reasons for the Zimbabwean Dollar depreciation and currently being traded at a black-market rate of US$1:ZWL$800 is due to the lack of faith the Zimbabwean community has on the government. Although corruption can not be completely eliminated, certain regions have substantially less corruption compared to other areas and I believe that most EU countries do have faith in the ECB.

Please see below the source of where I retrieved some of my information from.

https://www.forbes.com/sites/stevehanke/2017/10/28/zimbabwe-hyperinflates-again-entering-the-record-books-for-a-second-time-in-less-than-a-decade/?sh=32e381db3eed

https://www.bbc.co.uk/news/58888451

https://www.washingtonpost.com/business/why-the-euro-has-tumbled-to-parity-against-the-dollar-quicktake/2022/07/13/149fedda-02ab-11ed-8beb-2b4e481b1500_story.html

Kind regards,

Nqobani Ndebele

Disclaimer: I am not qualified to give financial and/or investment advice. These are my personal opinions and remember every time you invest, your capital is at risk.