My Fourth anniversary with Econet.

What I have learnt after tying the knot with Econet in the past four years.

Introduction

I would like to express my apologies for my prolonged absence of 17 months. During that period, I was on a 12-month internship and have recently commenced my final academic year at the university. Despite my busy schedule, I have received numerous requests to resume writing and provide updates to my readers. With that said, I would like to delve into the topic and provide a valuable contribution to the ongoing discussion.

Upon checking my calendar, I realised that February 2024 will mark the fourth anniversary of my investment as a shareholder in Econet. I made this investment when I was 18 years old by purchasing shares from Econet Wireless. As I reflect on my experience, I have gained invaluable insights on investing and the Zimbabwe Stock Exchange.

Why Econet?

Compound interest is the key to successful investing. This means that the earlier you start investing, the better your returns will be. When you are young, you can take more risks, and investing in Zimbabwean companies is considered an extremely high-risk strategy due to the country's economic situation. However, Zimbabwean stocks are relatively cheap, which makes them an attractive investment option. But out of the 45 companies listed on the Zimbabwe Stock Exchange (ZSE), why was Econet my first investment? Econet Wireless is a diversified telecommunications group with a market share of 69.9% in the national mobile subscriber base.1 Econet is also a part of Old Mutual’s ZSE Top 10 ETF, as it has the third-largest market capitalisation on the ZSE.2

Source: african-markets. Note some companies like Innscor were previously members of the ZSE Top 10 index, however, they were delisted from the ZSE and listed on the USD-denominated VFEX (Victoria Falls Exchange).

If you ask any Zimbabwean about Econet's intrinsic value, you will quickly realise that it is a value stock. (Although Zimbabweans generally have a love-and-hate relationship with Econet because of tariff price hikes). As an avid fan of Warren Buffett, I implement his famous value investing strategy.3 This value investing strategy points to investing in companies that are stable, undervalued, and simple to understand.

What’s been happening to Econet?

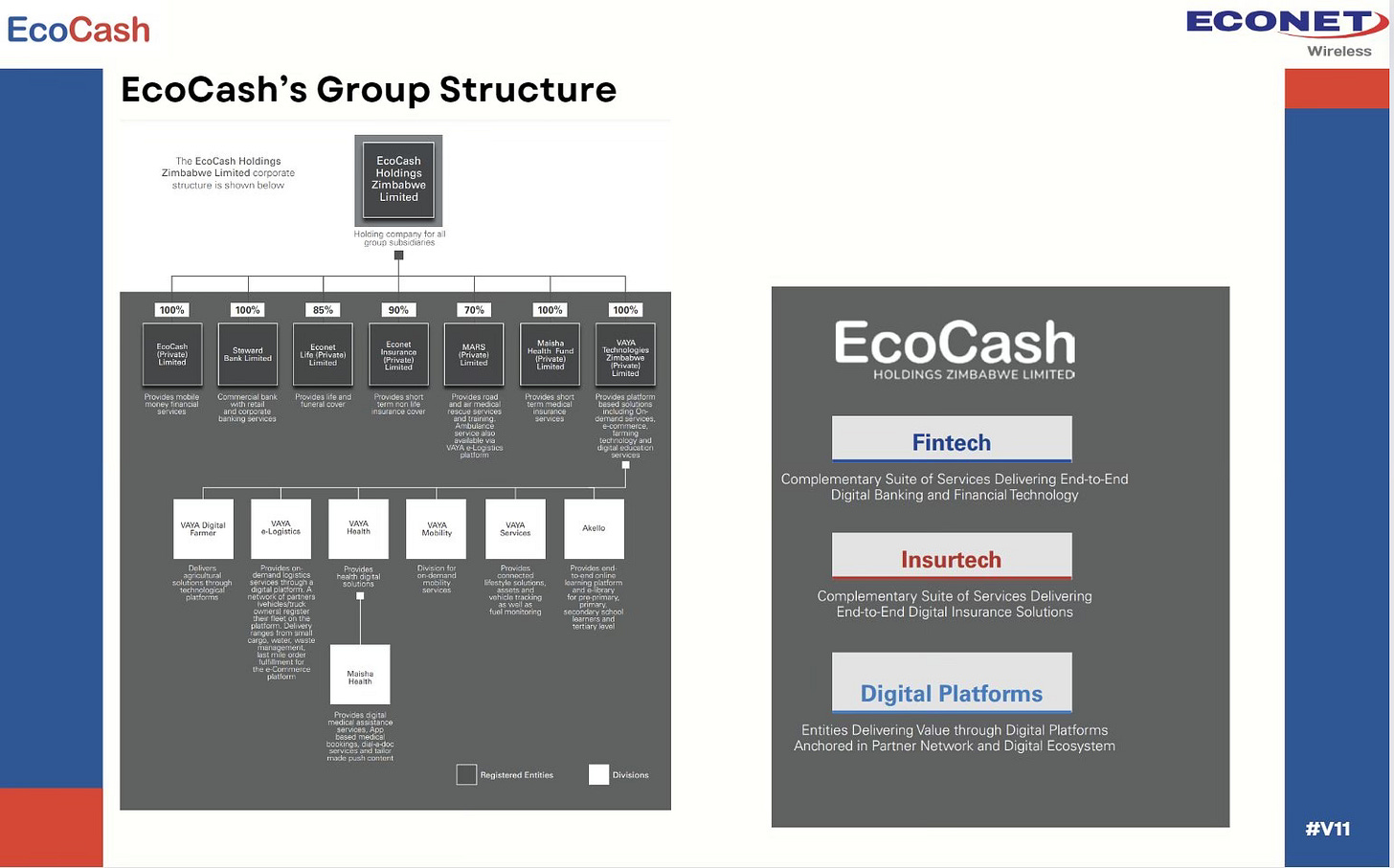

A lot has happened at Econet recently, including a major change that was announced - the decision to re-merge six fintech firms from EcoCash Holdings4. In 2018, EcoCash Holdings was created as a result of a demerger from Econet and was called Cassava Smartech Zimbabwe. The strategic move to re-merge these businesses is expected to mostly benefit Econet by strengthening its balance sheet, which will in turn unlock shareholder value.5 As a value investor and shareholder, I welcome this move. Value investors typically use various financial ratios to evaluate companies, and the re-merger is likely to increase Econet's price-to-book ratio (P/B), an important fundamental value financial ratio.

Source: (X account: @tmukogo)6

The present group structure of EcoCash reveals that Steward Bank Limited would be the only remaining firm within the group. This implies that the management of EcoCash can now concentrate entirely on enhancing the operational efficiency of Steward Bank. With Econet having acquired six firms, including EcoCash, it is highly probable that EcoCash Holdings will rebrand to Steward Bank on the ZSE bourse.

Although the acquisition of six fintech firms is good news, Econet's market capitalisation has decreased. At the end of 2022, Econet's market capitalisation on the ZSE was US$364.45 million in real terms. However, by the end of last year, the market capitalisation of Econet had fallen to US$358.98 million due to the sharp depreciation of the local currency. Econet's listed shares on the ZSE were affected because the bourse uses the Zimbabwe dollar as its currency of trade. While last year saw a slight dip in the market capitalization of Econet in real terms, the company has seen increased interest in its shares since the beginning of this year. This is because investors have increased their trades in stable counters such as Econet to hedge against the depreciation of the local currency, which had lost 75.38% of its value year to date as of 7 February.

Takeaways

The biggest takeaway is that investing in a hyperinflationary economy like Zimbabwe is no walk in the park. For my own sanity, I barely pay attention to the monthly volatility of my shareholding or else I will have sleepless nights. If you are looking to make a quick buck, regardless of where you investing, the stock market is not ideal. The biggest risks to Zimbabwean stocks are the geopolitical and economic factors.

In 2020, the ZSE bourse suspended Old Mutual, SeedCo and PPC. According to the government, these companies were responsible for fueling the parallel market rate. The government suspected that the use of fungible counters was worsening the depreciation of the domestic currency, which has been declining since 2016. Fungible counters are stocks that are traded on more than one stock exchange. For instance, Old Mutual trades on multiple stock exchanges, such as the Johannesburg Stock Exchange, London Stock Exchange, and at that time, the Zimbabwe Stock Exchange.

Old Mutual was one of the stocks in my Zimbabwean portfolio. However, even after four years, I am still unable to access my shares. Although I still receive dividends, this has caused frustration among foreign investors who bought Old Mutual shares due to its high dividend yields.

Source: Zimbabwe Independent

One such investor is Cambria Africa Plc, which is a multinational investment firm listed on the London Stock Exchange. They have applied to the government to return their Old Mutual stocks that they originally acquired on the Johannesburg Stock Exchange.7 This geopolitical instability scares away foreign institutional investors. In terms of economic factors, I do not think I need to say more - I mean this is Zimbabwe we are talking about.

In summary, I have a high-risk tolerance when it comes to investing in Zimbabwe, although this may not be the case for most investors. I hope that during my lifetime, the Zimbabwean economy will improve, resulting in profitable returns on my investments. At present, Econet's share price is ZWL $1,800, which is an increase from ZWL $2.20 four years ago. However, this increase in share price is more due to the devaluation of the local currency rather than an actual increase in company value. Nevertheless, Econet is a highly stable company with promising future earnings. If you are considering investing in Zimbabwe's future, Econet is undoubtedly one of your best bets.

Kindly be advised that the following disclaimer applies: Nqobani Ndebele, while not an accredited investor, holds a shareholding in Econet Wireless. It is important to note that this may result in a potential conflict of interest and as such, any expressed opinions may be biased.

https://www.africanwirelesscomms.com/news-details?itemid=5952#:~:text=As%20of%20the%20end%20of,Authority%20of%20Zimbabwe%20(POTRAZ).

https://www.african-markets.com/en/stock-markets/zse/listed-companies

https://www.investopedia.com/articles/01/071801.asp#:~:text=Buffett%20follows%20the%20Benjamin%20Graham%20school%20of%20value%20investing.,by%20analyzing%20a%20company%27s%20fundamentals.

https://www.thezimbabwemail.com/business/econet-to-acquire-6-ecocashs-fintech-firms/

https://www.newsday.co.zw/theindependent/local-news/article/200023472/econet-to-diversify-revenue-streams-with-ecocash-holdings-deal

https://www.newsday.co.zw/theindependent/business/article/200023392/cambria-seeks-to-recover-old-mutual-shares